IFFCO Tokio Health Insurance

IFFCO Tokio health insurance offers a comprehensive health insurance solutions to individuals and families across India. It has a wide presence in rur...Read More

Network hospitals

7000+

Claim settlement ratio

90.65%

Sum insured

Up to1 Crore

No. of Plans

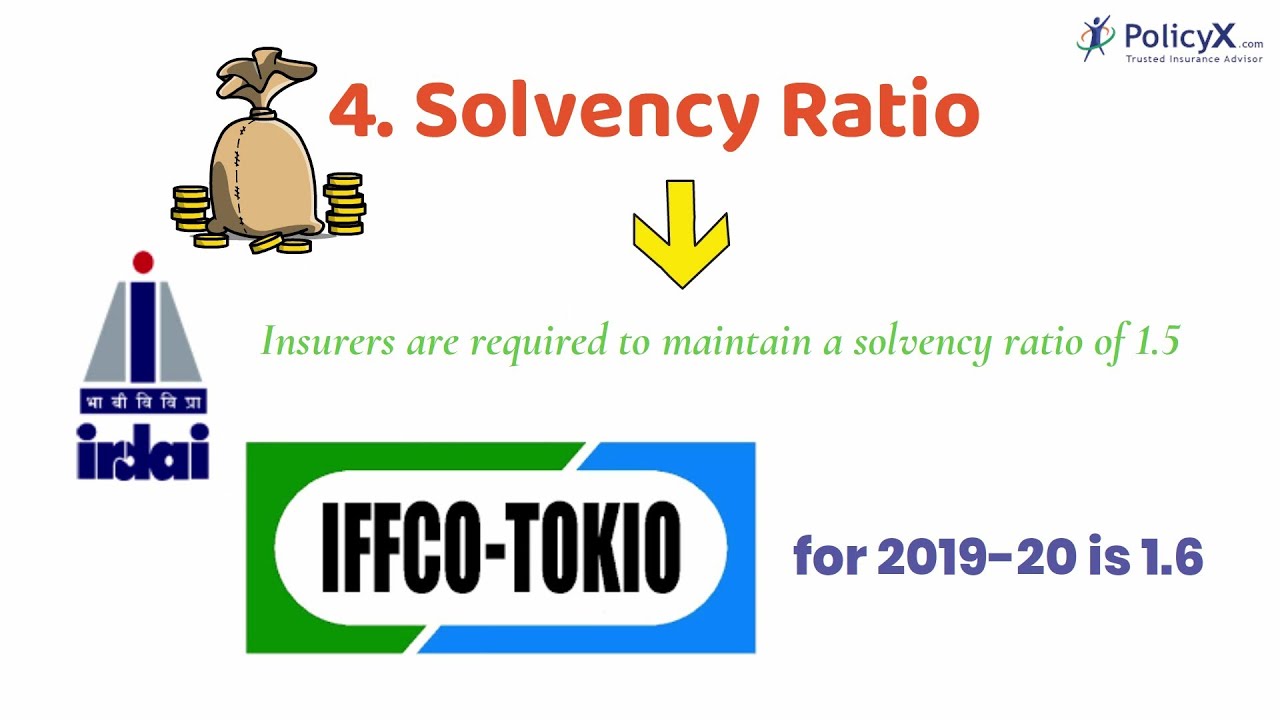

2Solvency Ratio

1.7

Pan India Presence

63+

Choose 1st Company

Choose 2nd Company

Compare

Best Selling IFFCO Tokio Health Insurance Plans

Let's take a look at the list of health insurance plans that offer comprehensive protection to you and your family

-

Individual and Family Health Insurance

IFFCO Tokio Health Insurance Plans Eligibility Approximate Annual Premiums IFFCO TOKIO MOS-Bite Protector Policy Entry Age - 18 to 65 Years

Sum Insured - Up to 1 LRs. 44

Family Health Protector Policy Entry Age - 18 to 65 Years

Sum Insured - Up to 30 LRs. 6,208

Key Features Of IFFCO Tokio Health Insurance

Let us take a look at some unique features of top-selling IFFCO Tokio Health Insurance policies:

For Individual and Family Health Insurance

IFFCO TOKIO MOS-Bite Protector Policy

It is a benefit health plan offering wide coverage against vector-borne diseases. The plan offers a lump sum benefit if you are diagnosed the listed vector-borne diseases.

Why Do We Recommend This?

- Dengue fever Coverage

- Malaria Cover

- Kala-azar Cover

Recommended Videos

Why Choose IFFCO Tokio?

- Versatile and affordable health insurance plans for every need

- 24X7 customer support for easy claim settlement

- Over 7000 network hospitals all over India

- Offers comprehensive coverage at affordable premiums

- Tax benefits under Section 80D of the Income Tax Act

Factors to Consider While Buying A Health Insurance Plan

Choosing a health insurance plan can be complicated. But when you have an idea of what the plan is about and what are the things you need to consider before making the decision. Here are some of the factors that you should consider before buying a health insurance policy-

- Individual or Family Floater Plan

Whenever choosing a plan your first step should be to check whether your requirement is for yourself or for your family. Most of the time family floater plans are beneficial for those who want to secure their family as it is cheaper than the individual one. - Cover Amount

We all know that with growing inflation, medical expenses are also increasing day by day. Therefore, having health insurance will help a lot to meet the expenses. In this, it is also necessary to choose a policy that offers maximum coverage and amount for your health claims. - Co-Payment Clause

Every policy has some clauses that you need to follow. A co-payment clause is one of those clauses. This means that for every claim you make, you have to bear a certain percentage of the claim amount. So, you must check how much clause your policy is putting in. - Hospital Network

Always check the list of network hospitals included in your policy. Keep in mind what kind of medical facilities you might need in the future. - Waiting Period

Look for the time period you need to wait before claiming the reimbursement. Some policies put a waiting period on critical illness as well, you need to check for that too. - Lifetime Renewal

It might be possible that you need healthcare when you grow old. So, look for a policy that provides lifetime renewal options. - Compare the Premiums

You should always choose the premium after comparing more than two policies. This thoughtful action will prevent you from paying a higher amount for lesser claims and vice versa.

What Are The Different Waiting Periods In IFFCO Tokio Health Insurance Plans?

The various waiting periods associated with IFFCO Tokio Health plans are:

Initial Waiting Period

Begins from the date of purchase and lasts for up to 30 days for most IFFCO Tokio Health Insurance plans.

Pre-existing Disease Waiting Period

IFFCO Tokio Health Insurance plans require you to serve specific waiting periods in case you are diagnosed with PEDs such as hypertension, diabetes, or any other.

Survival Period

Like waiting periods, IFFCO Tokio health insurance plans with critical illness coverage have a survival period. During this period policyholders diagnosed with any listed critical illness must outlive the survival period to enjoy coverage benefits.

IFFCO Tokio Health Insurance Network Hospital List

IFFCO Tokio Health Insurance Network Hospitals are present in 31 states nationwide. With a wide network of hospitals, IFFCO Tokio Health Insurance ensures that you are medically secured, irrespective of the city you reside in.

Documents Required For IFFCO Tokio Health Policy Claim Settlement

Submit the following documents when filing for Niva Bupa health claims:

- Duly completed and signed claim form, in original

- Valid photo-ID proof

- Medical practitioner's referral letter and prescription

- Original bills, receipts, and discharge cards from the hospital/medical practitioner

- Original bills from pharmacy/chemists

- Original pathological/diagnostic tests reports/radiology reports and payment receipts

- Indoor case papers

- First Information Report, final police report, if applicable

- Post-mortem report, if conducted

- Any other document as required by the company to assess the claim

More Queries?

If you have any more queries regarding

Plans,

Renewals, or Claim Procedures, contact our insurance experts at:

1800-4200-269

now!

Other Health Insurance Companies

Compare mediclaim policies with other top insurers in India.

Know More About Health Insurance Companies

Share your Valuable Feedback

4.4

Rated by 2635 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Simran Saxena

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Reviewed By: Anchita Bhattacharyya

Reviewed By: Anchita Bhattacharyya

Do you have any thoughts you’d like to share?